In an era of rapid change and growing uncertainty, the pursuit of financial security cannot be separated from robust legal safeguards. By aligning your financial life and legal safeguards, you build a dynamic framework that protects your assets, guides your legacy, and honors your values. This integrated approach offers both peace of mind today and a resilient foundation for tomorrow.

Holistic planning goes beyond balancing budgets or drafting a will in isolation. It embraces a comprehensive view of your wealth, merging income management, risk protection, investments, tax strategies, retirement goals, and estate documentation into a unified strategy. This approach ensures no gap or overlap leaves you vulnerable to unexpected life events.

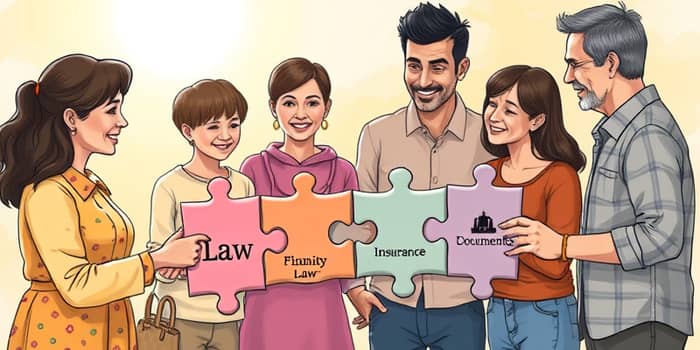

On the legal side, traditional estate planning expands to include healthcare directives, power of attorney appointments, and long-term care decisions. By synchronizing these legal instruments with financial objectives, clients achieve integrated financial and legal framework that reflects their personal values and family needs.

A successful holistic plan rests on several key pillars. Each component addresses a critical dimension of your financial and legal life, ensuring that every decision reinforces the overall strategy.

By weaving financial tactics with legal foundations, individuals and families enjoy a range of advantages that extend beyond mere convenience.

Implementing a holistic strategy may seem complex, but a clear, methodical process makes it manageable and rewarding.

Digital solutions have revolutionized the way advisors and clients collaborate. Interactive dashboards, scenario modeling, and secure document vaults enhance transparency and collaboration, allowing stakeholders to visualize the entire plan in real time. These tools reduce misunderstandings and empower clients to make informed choices.

Consider the 50/20/30 budgeting rule, a simple yet effective guideline that can be integrated into broader planning efforts. By allocating 50% of after-tax income to needs, 20% to savings, and 30% to wants, individuals create a stable foundation for more complex financial engineering and legacy planning.

Despite the clear benefits, obstacles can arise when advisors operate in silos or clients delay legal updates. To overcome these hurdles, establish regular communication protocols and designate a lead advisor responsible for coordinating all strategic pieces.

Outdated documents, changing regulations, and unanticipated family events can derail even the most carefully crafted plan. By scheduling annual or event-driven reviews, you ensure that your strategy remains current and effective. Education and proactive dialogue foster trust and encourage timely decision-making.

As financial markets evolve and legal landscapes shift, the demand for truly integrated planning will only intensify. Embracing a holistic mindset empowers individuals to navigate complexities with clarity, resilience, and purpose.

By combining financial savvy with legal foresight, you create comprehensive future-proof solutions that honor your legacy and safeguard what matters most. Begin your journey today, and step into a future where your wealth and wishes are seamlessly protected.

References